26+ What is borrowing capacity

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Financial institutions always analyse borrowing capacity before granting or turning down a loan or mortgage application.

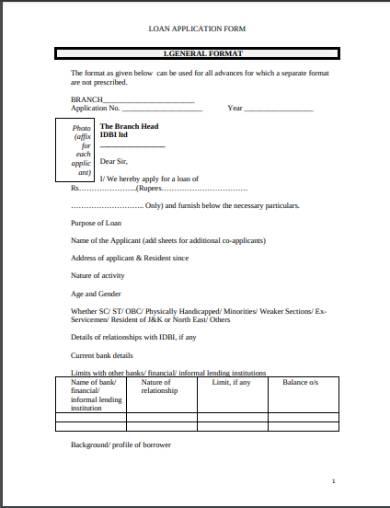

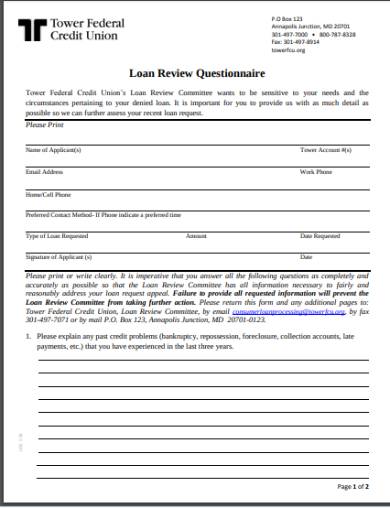

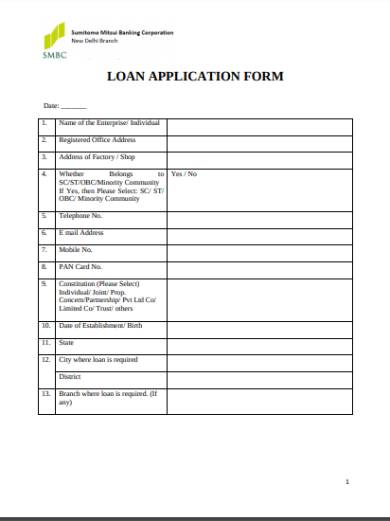

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

Understanding the borrowing capacity is an essential step before making a loan.

. Lenders commonly discuss borrowing capacity with client but that does not mean it is your max or what you would like. Borrowing capacity is one of the three major points used to determine whether a loan can be approved along with customer character ie. Borrowing capacity is the amount of money a bank or financial institution will extend to you based on your current financial position.

View your borrowing capacity and estimated home loan repayments. How is borrowing capacity calculated. Lenders will compile your sources of income.

The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance. Increase your borrowing power by reducing the number of additional features on your home loan extending your loan term and improving your credit score. A mortgage broker can find out your max because they have the.

Borrowing capacity is the maximum amount of money you can borrow from a loan provider. Your survival depends on it hence the interest of scrutinizing the following paragraphs. Borrowing capacity is defined by the amount you can obtain from your bank to finance the purchase of your future home.

Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. The borrowing base is. It uses a median expenditure on basic expenses eg.

Credit history employment history. Borrowing capacity Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency. Your borrowing capacity is the amount a lender will lend you to buy a property.

Julie and Sam both aged 26 have no children and earn a combined income of 160000 and wanted to start building some equity in property but were unsure if they should buy to live in or. Compare home buying options today. Estimate how much you can borrow for your home loan using our borrowing power calculator.

A borrowing base is the amount of money that a lender is willing to loan a company based on the value of the collateral the company pledges. The figure may become part of a lenders calculation when assessing your borrowing capacity. The exact amount will depend on the lenders borrowing criteria and your.

Borrowing Capacity means the ability to obtain draws or advances at the request of a Guarantor or any Affiliate or Subsidiary of a Guarantor in Dollars and within three 3. Different lenders require different. The borrowing capacity is calculated based on your income current assets your deposit amount existing.

It is a main component to determine the type.

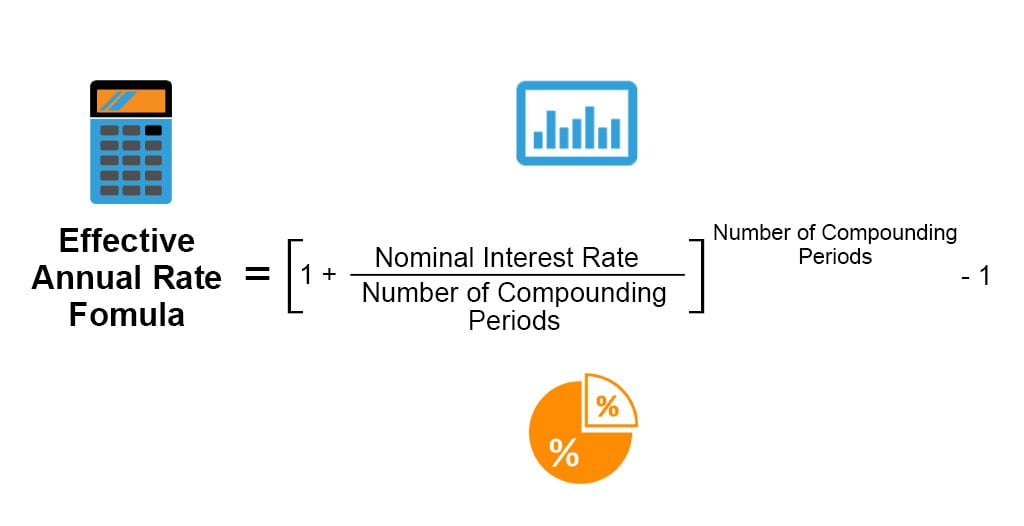

Nominal Interest Rate Formula Calculator Excel Template

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

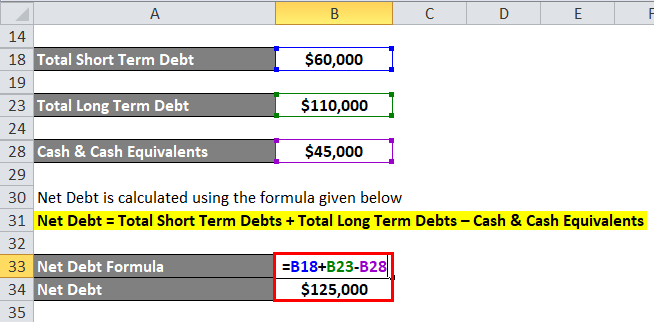

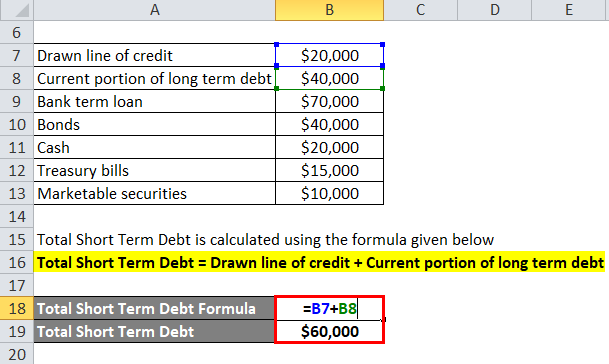

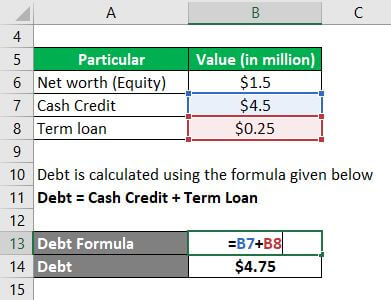

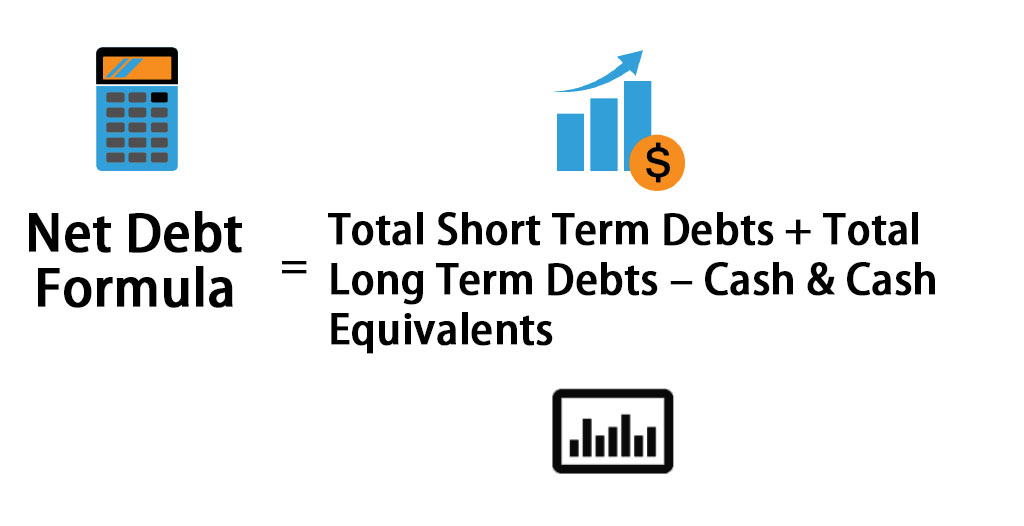

Net Debt Formula Calculator With Excel Template

Request Is This Accurate Both His Statement And The Response R Theydidthemath

18 Borrowing Capacity Halinalleyton

Effective Annual Rate Formula Calculator Examples Excel Template

Net Debt Formula Calculator With Excel Template

Capital Structure Complete Guide On Capital Structure With Examples

Pin By Mary Fischer On Naruto Star Wars Toys Action Figures Star Wars Tshirt Star Wars Luggage

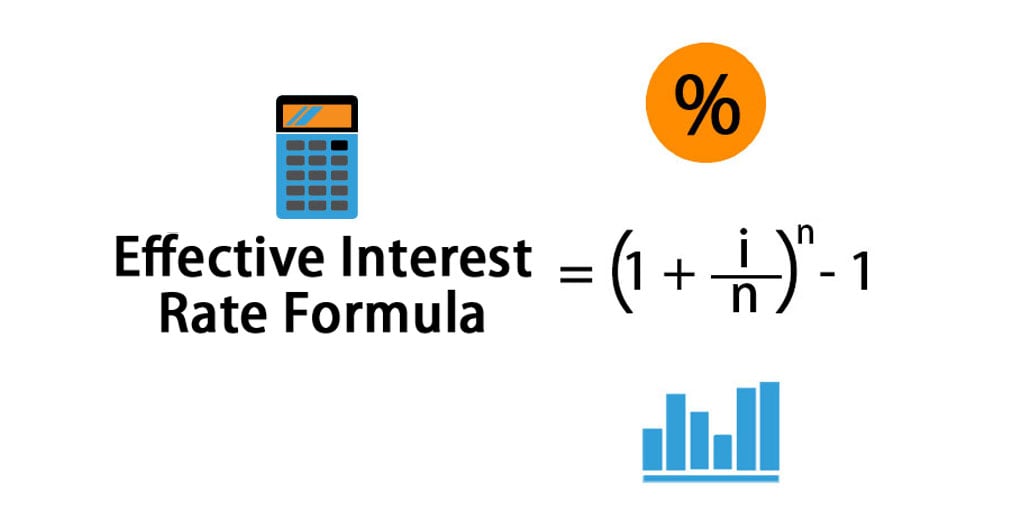

Effective Interest Rate Formula Calculator With Excel Template

10 Agreement Between Two Parties For Money Examples Format Sample Examples

What Is An Open House By Appointment Only In Nyc Hauseit

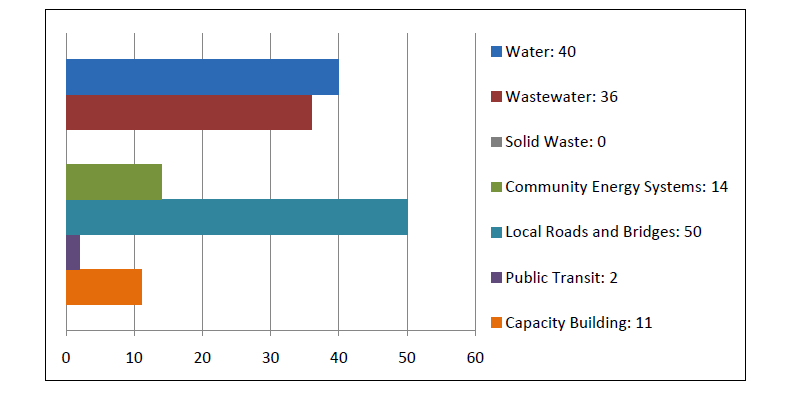

Crc Case Studies

Net Debt Formula Calculator With Excel Template

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

2

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf